- Real estate investment property evaluator spreadsheet registration#

- Real estate investment property evaluator spreadsheet software#

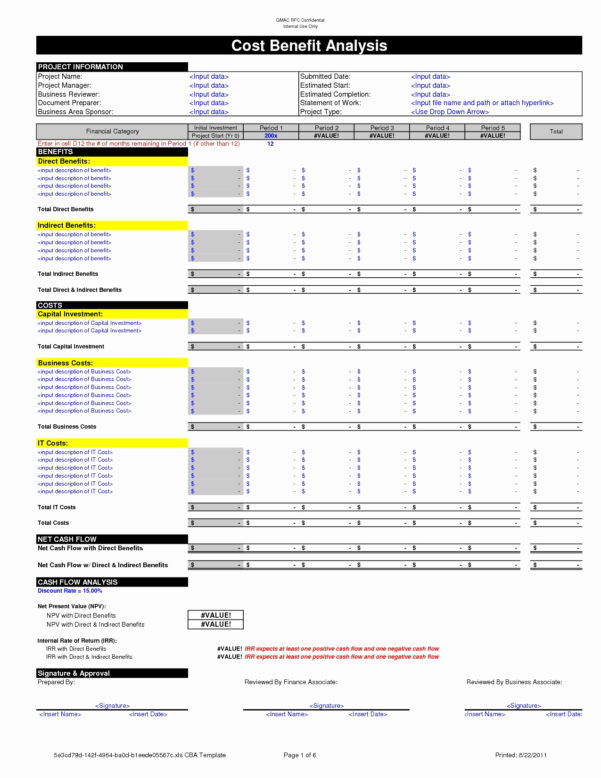

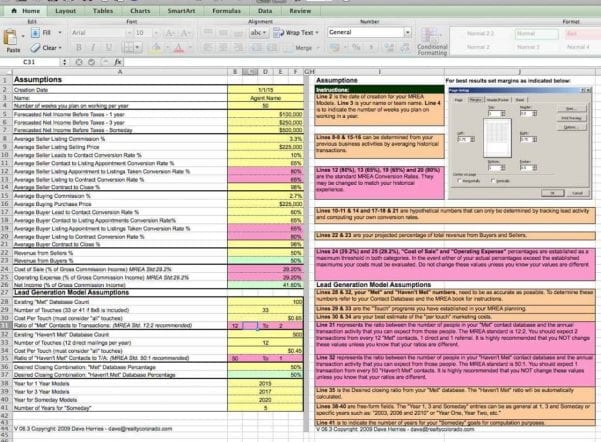

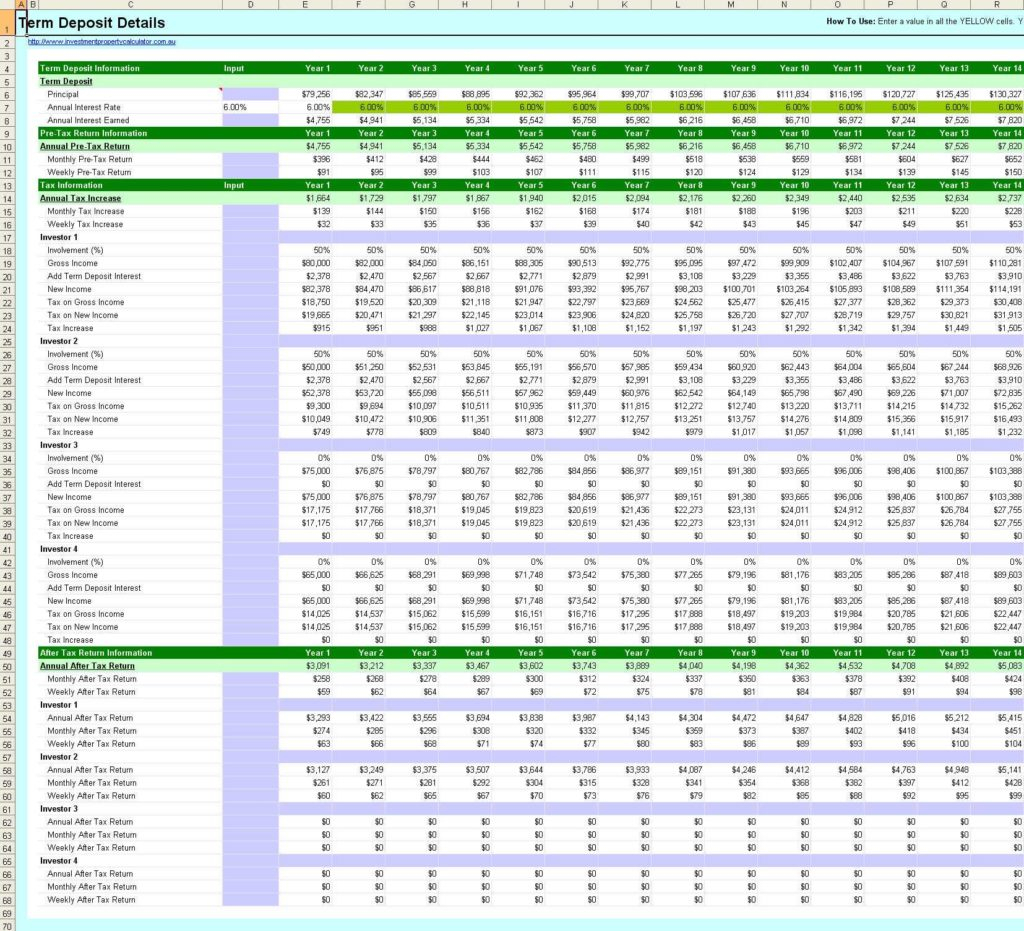

The value of this research is the analytical tools and rigour it avails investors seeking income returns and growth from reversionary leasehold property as an instance of terminable investments. With recourse to the hybrid leasehold DCF valuation model, the spreadsheet-assisted scenario was found to produce mathematically valid growth rates that justify the valuation of leasehold investment properties part-way through rent review periods. From a total of eleven scenarios generated, the 9th successive scenario produced optimal results indicating zero slack between iterated and calculated values for the growth rates of leasehold cash inflows and cash outflows respectively. A precursor to the scenario analysis was the development of a hybrid leasehold DCF valuation model arising from the equation of the formula for reversionary leasehold equivalent yield valuation to the formula for reversionary leasehold growth explicit DCF valuation model thereby culminating into the identification of four unknown variables comprising the all risks yield and the implied growth rates of leasehold cash inflows and cash outflows which were subsequently derived using the solver tool of Excel ®. This study examined the spreadsheet-assisted scenario analysis tools and techniques that are required for the determination of rental growth rates of leasehold investment properties valued part-way through rent review periods. Although existing studies addressed this phenomenon in freehold investments, a relative question regarding the determination of rental growth rates of leasehold investment properties valued part-way through rent review periods has not been addressed before now. Income growth rates are required to justify decisions and strategies for property investments. 1037 Idah, Kogi State, NigeriaĮxplicit DCF appraisal, Equivalent yield valuation, Implied rental growth, Reversionary leaseholds, Scenario analysis Abstract Property Depreciation (Year 1 estimate)įrom this data, the ANNUAL and WEEKLY cash flow BEFORE and AFTER tax benefits are displayed as well as projected Capital Growth based on The Cameron Bird Group’s research.Department of Estate Management and Valuation, The Federal Polytechnic Idah, P.M.B.

Real estate investment property evaluator spreadsheet registration#

Transfer and Mortgage Registration Feesġ4. Cost of Furniture Package / Depreciation Schedule / Valuationsħ. Yes! 14 data points are all that are required to be entered into our investment property calculator (that are unique to each investor and their potential real estate investment purchase)Ģ. You will receive access to our in-depth investment property results which on average, is only about 9-12 recommendations per year.ĭoes the investment property calculator take into account all tax deductions and expenses? Our investment property calculator is free, absolutely FREE. We repeat, our investment property calculator is absolutely FREE. How much does the investment property calculate cost? We stand behind our claim that our investment property calculator that we have created is the best investment property calculator in Australia. At the end of inputting, the investment property calculator will display the BEFORE and AFTER tax net results. There are a small number of input fields required which are unique to each investor and their potential real estate purchase. The investment property calculator is an excel spreadsheet with a file extension of.

Real estate investment property evaluator spreadsheet software#

What format is the investment property calculator software in? We have developed this investment property calculator to take into account the different tax rates of an SMSF purchase and the different setup costs that occur with an SMSF purchase.

An SMSF purchase cash flow differs greatly to a standard property purchase. From the setup of the bare trust to concessional contributions to super after the purchase.

Yes! We also have an SMSF Cash Flow Analyser that works in the same manner but for Self Managed Super Fund Property Purchasers.

Can the investment property calculator be used on any real estate investment purchase in Australia?

0 kommentar(er)

0 kommentar(er)